MANILA, Philippines -

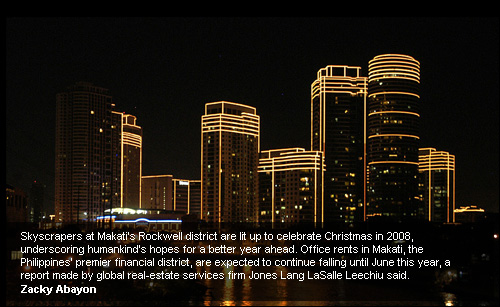

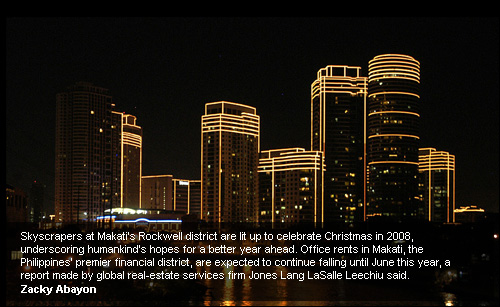

MANILA, Philippines - Office rents in Makati City, the Philippines’ premier financial district, are expected to fall until the second quarter of the year if market conditions continue to worsen due to global turmoil, a report said. Other emerging business districts in the country are likely to follow the same trend, Jones Lang LaSalle Leechiu, a global real-estate services company, said in a report entitled "Offshoring and Outsourcing (O&O): Charting the State of the Office Demand in the Philippines." Average monthly Grade A rentals, or office spaces in prime areas, in Makati “have gone down by 34 percent to P800 per square meter from levels seen in early 2008 while average monthly rentals in Bonifacio Global City have been flat at P600 to P800 per square meter due to the area's “ample labor pool that is strongly sought after by O&O companies,"" Claro dG. Cordero Jr., the company’s research and consulting head, said in the report. "The forecast decline in rental rates is perceived to be due to the expected slow growth in demand from O&O companies and the anticipated oversupply in the next two to three years," he said. Office rental growth in the Philippines will continue to be challenged by uncertain demand for office space due to both the weaker short term demand from the O&O industry and the lackluster performance of the traditional demand drivers – MNCs (multinational companies) that are engaged in financial and IT-related services," he added. Cordero noted the expected new office supply has been "substantially" reduced by seven percent since September, pointing out that the influx of business process outsourcing (BPO), IT outsourcing, and engineering services outsourcing has accelerated recovery of office rentals in the country. The Makati CBD is host to about 70,000 BPO seats with 500,000 square meters of office space while Bonifacio Global City has 25,000 seat covering 150,000 square meters, he said.

Next: Developers examine locations outside Makati as BPOs look for labor in rural areas Developers examine locations outside Makati as BPOs look for labor in rural areas Developers and investors have "projected a more cautious outlook as development yield continue to be less competitive compared with other markets," he said. Developers have also started looking outside the Makati CBD "due to the strategic decision of large O&O companies to look for untapped labor in the countryside." Cordero said it is expected the O&O industry, which aims to corner 10 percent of the global market share by next year with $13 billion in revenues, would trim down its forecasts. "A downgrading of this projection is to be expected, given the short-term uncertainty arising from the reallocation of resources and the reconfiguration of the structure of affected companies. Local industry leaders are confident that over time, these companies, and probably even more, will begin to appreciate the value of outsourcing as an effective tool to further reduce costs amidst the challenging macroeconomic backdrop," he added. Business Processing Association Philippines (BPA/P) chief executive officer Oscar Sañez said recently targets would be reviewed by the middle of the year although he did not discount the possibility of slower growth. - Ruby Anne M. Rubio, GMANews.TV