Candidates’ business assets hidden from public view

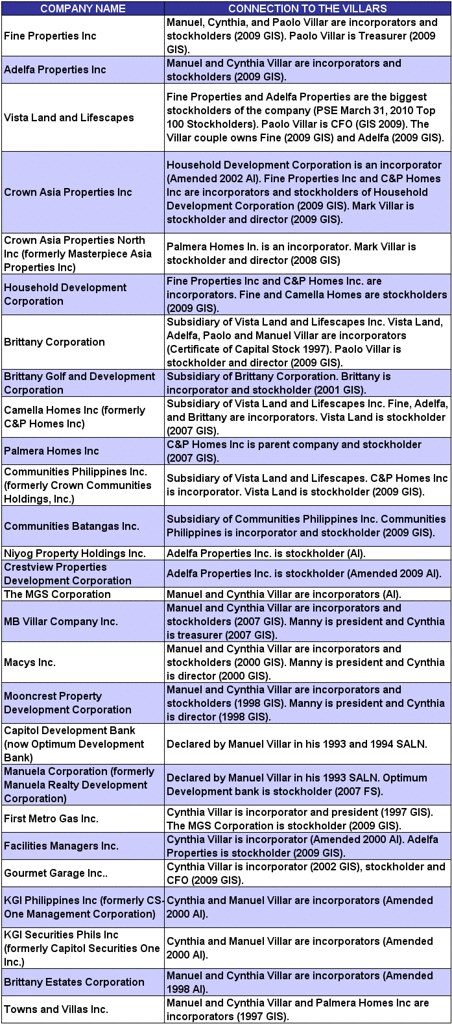

After the plunder trial and ouster of former President Joseph Estrada, the statement of assets, liabilities and net worth, now better known as the SALN, has become a more popular public window into the wealth of public officials. The Office of the Ombudsman says a new SALN form is in the works, being crafted together with the Civil Service Commission. But the SALN form has just been revised and is barely three years into implementation. The revised form had targeted greater transparency into declarations of personal wealth. Whether old forms or new forms, observers and advocates don’t think this is what’s essential. Milwida Guevarra, former finance undersecretary and convenor of The Movement for Good Governance, finds the disclosure and divestment provisions in the law “very weak." “There are several ways of skinning a cat and that is a very weak provision,“ Guevarra says. That the law itself, RA 6713 or the Code of Conduct and Ethical Standards for Public Officials and Employees, may be part of the problem has not escaped the attention of those who may be considered SALN experts. “RA 6713 on its own, meron nang limitations. Tapos… may kakulangan dun sa form itself, and sa specific questions," says Karina David, former CSC chair and author of the 2007 revised SALN form, noting the loopholes and work-around especially in the provision for disclosure. GMA News Research conducted a review of the SALN disclosures of those running for the highest office in the land: Senator Benigno Aquino III, Olongapo City Councilor JC De Los Reyes, former President Joseph Estrada, Senator Richard Gordon, Senator Maria Ana Consuelo Madrigal, former Defense Secretary Gilberto Teodoro Jr, and Senator Manuel Villar. All of the presidential candidates who have SALN records, seven of them, have professed compliance with the transparency requirements of the law. Yet the discussion below shows that the SALN’s sun does not illuminate all their business assets. Undeclared business interests GMA News Research went through the records of the Securities and Exchange Commission and the Philippine Stock Exchange to check the business connections and financial interests of the nine presidential candidates. A comparison of the SALN, SEC and stock market records shows that some business entities were not reflected in the SALNs of the presidential candidates. SEC records show Senator Madrigal has business interests in six companies not reflected in her SALN. The senator is a stockholder and member of the board of Madrigal Pacific Carriers Corporation from 2006 to 2009. The company was not listed in any of her SALN since 2006. Available SEC records show Madrigal as the Vice President for Operations, board member and stockholder of Pino Amadora Corp. in at least 2005 and 2008. This company was not listed in either her 2005 or 2008 SALNs. Madrigal was a board member and stockholder of Laxmi Holdings Inc from 2004 to 2007. She was director from 2006-2007. She was a member of the board and stockholder of Revelstoke Holdings Inc from 2004 to 2008, serving as director from 2006 to 2008. Madrigal also owns stocks in and is a member of the board of Radiant Holdings Inc from 2004 to 2008. She served as director from 2006 to 2008. Laxmi, Revelstoke and Radiant Holdings were not among those declared in Madrigal’s SALN since she started filing in 2004. Available company records of 2004 and 2005 show Madrigal and French husband Eric Dudoignon Valade as incorporators and stockholders of Harmony Therapy Centre (formerly Glorious Buddha Inc). Madrigal was chairman of the board in 2004. This company was not among those declared in her 2004 or 2005 SALN. In an interview for Votebook, GMA News asked Madrigal about the companies she did not declare in her SALN. She said, “Itong mga ibang corporations ay nasa estate pa ng father ko kanya hindi pa sa pangalan ko. Hindi ko naman ma-declare sa SALN ko yung hind ko pag-aari." The SEC records show the senator’s father, Antonio P. Madrigal, as stockholder of Madrigal Pacific Carriers Corp., Pino Armadora, Laxmi and Revelstoke as of 2009. But company records also show shares of stock identified as the senator’s. In the case of the youngest presidential bet, Olongapo Councilor Delos Reyes, SEC records show he was a member of the board of directors and stockholder of Barbara’s Food and Catering Services Inc from 2005-2008. This was not stated in De Los Reyes’ 2005 to 2008 SALNs. Barbara’s, named after JC’s mother Barbara Gordon Delos Reyes, is owned by the family. The incorporators, officers and stockholders are JC’s parents and siblings with Barbara as the chairman of the board. The company declared a net income of PHP 11,319,086 in its December 2008 financial statement. Administration bet Teodoro had business interests which did not appear in his SALNs. The former defense secretary’s name appears as incorporator and stockholder of Goldbase Mining Corporation and Multigold Resources Corp in the 1998 SEC records of both companies. Both companies had the same set of incorporators, officers and stockholders. These companies share business addresses at Ever Gotesco Center in Quiapo, Manila. PSE records show Goldbase is a “related party" of Gotesco Land, a real estate company. Teodoro’s shares in each company amounted to P100,000. These companies were not listed in Teodoro’s SALN when he assumed office in 1998 as representative of the 1st district of Tarlac. Based on SEC records, his wife Monica is a stockholder in Ringwood Holdings Inc and MLL Realty Holdings Inc. RA 6713 requires public officials to declare their business interests as well as those of their spouses and unmarried children under eighteen years old. But MLL did not appear in Teodoro’s SALNs for the years 1998, 2000 to 2001, and 2004 to 2008. Ringwood was not reflected in the 1999 and 2001 declarations. Monica Teodoro’s shares in Ringwood based on company records in 2001 is P1 while her share in MLL Realty amounts to only P100 as of 2009. While Monica’s shares in the corporations appear to be simply token shares, the law nonetheless requires disclosure of business connections, regardless of amount. The former finance undersecretary says business interests, no matter how small, should be made transparent. “You cannot really say that since I only own one share I will not protect it," Guevarra says. Senator Aquino, whose candidacy has been dogged by issues related to the family-owned Hacienda Luisita, has admitted to minimal shares in the property. Yet Hacienda Luisita Inc. is not declared in the senator’s SALN. “Yung share ko… I think is .004% or something of the total. Yung pamilya ho namin controls 66% of HLI," Aquino said on GMA News’ Kandidato. “The law requires that all public officials should declare all their assets, liabilities, financial interests and business connections. All, no matter how big, no matter how small," Assistant Ombudsman Jose De Jesus says. “You can always add an additional page if the form is not enough to cover all your data," De Jesus said. It would have been no surprise if Senator Villar did attach a few more pages to his disclosure. Villar is known for being king of a business empire and has been consistently the wealthiest legislator for at least a decade. Obscured by corporate layers GMA News Research found that the Villar family, including the couple and their three children, has or had connections to at least 52 business entities and at least four non-stock and non-profit organizations registered with the Securities and Exchange Commission. The Villar couple has or had connections to at least 27 companies while their children have or had business interests in at least 25 other companies. Villar, however, does not need to declare the business interests of his children since they are all above eighteen years old. SEC records of 2008 show both Fine and Adelfa are almost exclusively owned by the Villar couple: Manny owns 51.02% of Fine’s stocks, 52% of Adelfa’s, while Cynthia owns 48.86 of Fine’s and 48%.of Adelfa’s. These two companies act as incorporators and stockholders of the other companies, mostly in real estate. Of the 27 companies with business links to the couple, Villar has consistently declared only five companies since 1993 up to 2008: • Adelfa Properties Inc. • Fine Properties Inc. • Macys Inc. • MB Villar Company Inc. • Mooncrest Property Dev Corporation He has also declared four other companies in various years: • Capitol Development Bank (now Optimum Development Bank) from 1993 to 1997 • C&P Homes from 1994 to June 1998 • First Metro Gas from 1993 to July 1995 • Manuela Corporation in 1993 Companies connected to Senator Manuel Villar and his wife Cynthia Villar  Companies connected to the three children of Manuel Villar

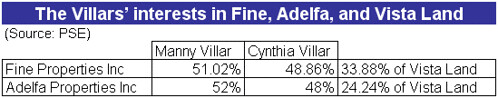

Companies connected to the three children of Manuel Villar  In an interview with GMA News for Votebook, Villar admitted that he has financial interests in Vista Land and Lifescapes. He, however, did not declare Vista Land in his SALN. Vista Land and Lifescapes declared assets amounting to P52.8 Billion as of Sept 30, 2009. Its net income for the same year was more than half a billion. Its subsidiaries include Brittany Corporation for high-end real estate developments, Crown Asia for middle market customers, Camella Homes for low-cost housing projects, and Communities Philippines for developments outside Metro Manila. Villar’s connection to Vista Land , despite being common knowledge, is obscured by layers of corporate paper. SEC documents do not directly list Villar or his spouse Cynthia as incorporators or stockholders. “Hindi ako director nyan, hindi ako officer nyan, matagal na… since ma-elect ako na ano… na public official. Hindi na ako nakikialam dyan," he told GMA News. “Libo-libo may-ari nyan. Syempre malaki stocks namin dito, pero public company na iyan," he added. While Vista Land , a publicly listed company, may have thousands of stockholders, Villar fails to mention that Vista Land’s two biggest stockholders are Fine and Adelfa, both owned by Villar. Based on PSE documents, Fine Properties owns 33.88% of Vista Land stocks, while Adelfa Properties Inc owns 24.24% as of March 2010. The combined shares of the two Villar companies make up 58 percent of Vista Land, or more than half of the holdings company. The Villars’ interests in Fine, Adelfa, and Vista Land (Source: PSE)

In an interview with GMA News for Votebook, Villar admitted that he has financial interests in Vista Land and Lifescapes. He, however, did not declare Vista Land in his SALN. Vista Land and Lifescapes declared assets amounting to P52.8 Billion as of Sept 30, 2009. Its net income for the same year was more than half a billion. Its subsidiaries include Brittany Corporation for high-end real estate developments, Crown Asia for middle market customers, Camella Homes for low-cost housing projects, and Communities Philippines for developments outside Metro Manila. Villar’s connection to Vista Land , despite being common knowledge, is obscured by layers of corporate paper. SEC documents do not directly list Villar or his spouse Cynthia as incorporators or stockholders. “Hindi ako director nyan, hindi ako officer nyan, matagal na… since ma-elect ako na ano… na public official. Hindi na ako nakikialam dyan," he told GMA News. “Libo-libo may-ari nyan. Syempre malaki stocks namin dito, pero public company na iyan," he added. While Vista Land , a publicly listed company, may have thousands of stockholders, Villar fails to mention that Vista Land’s two biggest stockholders are Fine and Adelfa, both owned by Villar. Based on PSE documents, Fine Properties owns 33.88% of Vista Land stocks, while Adelfa Properties Inc owns 24.24% as of March 2010. The combined shares of the two Villar companies make up 58 percent of Vista Land, or more than half of the holdings company. The Villars’ interests in Fine, Adelfa, and Vista Land (Source: PSE)  Both Fine and Adelfa have been declared in Villar’s SALN since 1993. These two companies link Villar to more than 20 other business entities. Should all these inter-linked companies then be listed in the SALN? Former Civil Service Commission Chair Karina David says it is acceptable for public officials to declare only companies where they, as individuals, have actual interests in. “Kunyari ako, part owner ng company A, ang company A, created company B, wala na ako doon," David says. David is the author of the revised SALN form introduced for 2007. This format requires the public official to declare a baseline data, or a “comprehensive listing of all assets, liabilities, net worth, business interests and financial connections" using the year 2007, or the first year of filing, as reference. The succeeding annual SALNs will only reflect the changes from the initial declaration, either addition (if there is an increase in assets/ income) or deduction for additional liabilities. "Di ba mas maganda na minsan lang, the moment you come into government, dun ka lang nagde-declare ng lahat ng bituka mo. Tapos every year, I think 70 percent or 80 percent of the bureaucracy will simply say 'no change,' " David says. On the question of whether Vista Land should be in Villar’s SALN, Prof. Solita Monsod says, "He [Villar] does not have to declare it [Vista Land] because he already declared Adelfa [and Fine Properties]. Wala syang problema..." Prof. Monsod was head of the National Economic and Development Authority and now chair of The Movement for Good Governance, a civil society organization. “He owns the holding company. The holding company owns another entity. As long as he says he owns the holding company, ikaw na bahala magsabi kung saan yun [other business interests]. [Because] yung profits ng companies owned by the holding company goes to the holding company," Monsod says. While David says this kind of disclosure is acceptable and may be taken as compliance with the law, she likewise notes that compliance is not necessarily equivalent to transparency. “It’s so smoke-screened eh. How can you keep on earning so much money… simply because a great set of lawyers was able to hide you from all these things?" she said. “As usual, lawyers can forget about the spirit of the law and ‘technical’ you all over the place." The issue of disclosure of layered business entities is not unique to Senator Villar. Luisita Realty Corp. was not among the business interests listed in the SALNs of Senator Aquino. This company declared net income of P65 Million in 2005. SEC records show that 40 percent of the real estate company is owned by Tarlac Development Corporation. TDC has been in Aquino’s SALN since he started filing in 1998. In a similar case, Consolidated Mines Inc does not appear in Madrigal’s SALN. But AP Madrigal Steamship Company Inc and The Solid Guaranty Inc, companies listed in Madrigal’s SALNs, are stockholders of Consolidated Mines. The senator was VP for Operations, Member of the Board and stockholder of AP Madrigal Steamship from 2004 to 2008. Madrigal was Chairman of the Board and stockholder of Solid Guaranty in 2007. Declare all The word from the Office of the Ombudsman is clear and simple: just declare everything, layers and all. De Jesus says, “Well even if there are layers, I believe that he should declare all of them." "The law requires full disclosure, full disclosure," repeats the assistant Ombudsman for emphasis. “And if a lifestyle check is done on the public official, and it was found out that he did not declare the other companies that he owns or manages... he might be accused of - remember the declaration in the SALN is under oath - perjury or even falsification. Worse, there could be a petition for forfeiture of ill-gotten wealth." While these fighting words may intend to put the fear of God in every public official, the Ombudsman in some ways is a paper tiger. De Jesus explains there has to be a complainant for the Ombudsman to trigger an investigation into anybody’s SALN. There are three Deputy Ombudsman for Luzon, Visayas and Mindanao and a Deputy Ombudsman for the Military and other law enforcement offices. The Office of the Ombudsman is the repository of the required declarations of 1.4 million that make up the government bureaucracy. As is, the Office of the Ombudsman has enough on its plate. The onus therefore is on the complainant. “The burden of proof is on the complainant, to prove that this public official or employee has an ill-gotten wealth. Or that he committed perjury or falsification because by omission, he did not declare," De Jesus said. And, De Jesus adds, there should be some leeway for certain lapses. “But you know, you also have to consider good faith on the part of the declarant," he says. “Eh sa dami naman nga nyan, eh kung hindi naman nya maalala lahat, at nakalimutan din ng kanyang secretary, we cannot blame, as long as he declares that he has interests in these corporations: this is the mother unit, there are smaller units." But David counters, “There are limits naman to good faith." “To say that you forgot to declare a huge chunk [of your wealth or] you forgot to declare the income of your husband, eh it’s unbelievable. If everything is good faith wag na tayo magpa-submit," she says. Vague, inconsistent entries There seems to be greater leeway in the declaration of real estate properties whose worth can vary depending on the measure used. From 1994 to 1996, Delos Reyes used the assessed values of his two properties in Subic Bay Metropolitan Authority and in Olongapo City. In 1997, he started computing the value of the same properties using the fair market values. Teodoro has declared a condominium property in Makati since July 1998 to 2007 with an acquisition cost of P10 Million. In 2008, the declared acquisition value of the same property changed to PHP 17,482,000. Villar’s declared from 1997 to 2001 a residential property on Naga Road in Las Piñas with an acquisition cost of P500,000. From 2002 to 2006, the acquisition cost for the same property became P600,000. Monsod says consistency is important in declaring the value of properties. “As long as you are consistent in the [values you use], then you have no problem. Because you cannot use one value for one asset and the fair market value for the other depending on what you like," she says. The 2007 revised SALN requires the acquisition costs and either the fair market or assessed value of real estate properties. In some declarations, the assets are simply lumped under a general, all-encompassing heading. Madrigal, for example, declared P90.48 Million under “shares of stocks." She did not identify where the investments were. This amount was equivalent to 59 percent of her declared totals assets in 2008. From 1992 to 2006, Villar declared multi-million-peso assets under “investment in shares of stocks" and “other personal assets/properties" but did not identify the companies. In 2008, he listed assets worth P789,235,608.00 under “receivables and other personal and real properties." This “receivable", equivalent to 75 percent of his declared assets and net worth, does not indicate where the sum will be coming from. Unlike many filers who invest in the stock market, Gordon identified investments made in publicly listed companies. Among all the presidential bets with SALN records, Gordon’s SALN declarations matched all the business records GMA News Research obtained from the SEC. There was only one inscrutable entry in his SALN, notable for the huge amount -- the lump declaration of his liabilities. Gordon declared liabilities worth P28,296,942 in 2008. This amount was 51 percent of his declared total assets. His liabilities listed only under “personal loan" started at P9 Million in 2001 and reached P28.7 Million in 2007. While Gordon declared liabilities worth more than half of his fortunes, Villar says he has none. Since December 1995, Villar has been declaring no liabilities. But what about the Villar companies that had gone belly up? Manuela Corporation, declared by Villar in his 1993 SALN, is under court rehabilitation based on its 2007 financial statement. In a 2007 decision on Manuela’s rehabilitation, the Supreme Court described the company as “having severe cash flow payments which prevent it from paying its debts as they fall due." Capitol Development Bank was in Villar’s SALN from 1993 to 1997. In 1998, Capitol secured a P1.5B emergency loan from the Bangko Sentral ng Pilipinas (BSP). The bank’s president then was Cynthia Villar, wife of Manny Villar, who was congressman at the time. When CDB failed to pay, the BSP secured real estate collaterals in the foreclosure proceedings. Capitol Development Bank has since been renamed Optimum Development Bank in 1999. Optimum is a stockholder of Manuela in the latter’s 2007 financial statement. Monsod sees no problem with these not being reflected in Villar’s SALN. “Eh kasi personal [SALN] nya yun eh, ang corporations nya ang may liabilities," Monsod said. “You must remember, yung utang is utang ng corporations nya. Eh nilista na nya… Ang corporations nya ang may liabilities." David says that there is no legal problem with not declaring corporate liabilities: “As usual, lawyers can forget about the spirit of the law and ‘technical’ you all over the place." She stressed, however, that the bottom line should always be transparency. “Alam mo, maraming magic na nangyayari sa business," she says. “They can answer you legally. Yung mga korporasyon may liabilities, ang tao wala… Pero yung tao ang laki-laki ng nakukuhang profits from these corporations. Obviously there’s something wrong. They just have good lawyers." Nothing to declare The ideal case, the assistant Ombudsman says, is to have nothing to declare. In a perfect world, government officials and employees would not have business interests at all because the law prohibits conflict of interest. “For example me, if I were an owner or a majority stockholder of a corporation, I will have to divest. I will have to sell out or donate my shares. I cannot practice my profession as a lawyer because I am required by the law to be a full time officer of the Office of the Ombudsman," he said. RA 6713 says there is conflict of interest if the official or employee is a substantial stockholder, or a member of the Board of Directors; or an officer of the corporation; or an owner or has substantial interest in a business; or partner in a partnership; and if the interest of the business affects the performance of his duties. For Guevarra, the involvement in any business is already conflict of interest. “They can justify their [wealth] through their businesses. [But] how do you separate how much income you have generated because of your connections, because of your power?" she asks. Guevarra says personal interests are bound to interfere with public service. “If there are laws... that may have a negative impact on your business, the probability is you will not be objective. Kasi you will be torn eh, between two lovers," she says. “Are you going to do what is good for the country, but at the same time it would harm your business interests?" But what we have is far from a perfect world. And as such, government has forms that need to be filled out. "Any form is always dangerous to small people," David says. "Because kahit sinong maliit na tao na maka-away mo, hahanapan ka at hahanapan ng butas… Even if it won’t stand up in court, you go through an entire process." In creating the 2007 SALN form, David simply wants an instrument that will make it easy for people to be honest. “Bakit mo pahihirapan yung 1.4 million government employees na karamihan naman dyan wala halos ma-declare," she says. "People who want to hide their corruption will find a way of hiding anyway." But from the perspective of the Ombudsman, the SALN should be an instrument that should help them go after crooks in government. Since SALN declarations are made under oath, those proven to have wrongfully declared their assets, liabilities and net worth may be held liable for perjury. "Ang perspective ng Ombudsman even during the time of [former Ombudsman Simeon] Marcelo was to come out with a form so that they would be able to find out all they needed in the form," David says. And now, the Ombudsman is working on a new form. “Bago na naman?" David says dryly. The Ombudsman, after all, has not had much success in the use of the SALNs for big-time prosecution. While the plunder case against Estrada prospered, the Sandiganbayan acquitted him of perjury for his erroneous SALN declarations. The landmark conviction eclipsed the government’s loss in the other battle. In the perjury decision, the Sandiganbayan said that while the prosecution was able to establish the omissions in his SALN, it was unable to prove that Estrada “deliberately and willfully committed a falsehood." “In order to be liable for perjury, the falsehood committed by the accused in his sworn statement must be deliberate and willful," the court explained. Even the recent developments from the Office of the Ombudsman had clearly not pointed in the direction of transparency and better public access, but in fact toward the protection of the public official. Last year, Ombudsman Merceditas Guttierrez issued a memo that made it harder to access the SALNs, which are public documents. The requesting party is now required to have his request sworn before an Ombudsman prosecutor. The memo reminds the requesting party that his written request shall be readily made available to the owner of the SALN, “who may avail himself of all legal remedies against the requesting party should said official or employee feel that the requesting party has unlawfully encroached on the former’s right to privacy." Clearly, there is much to be desired in the provisions on transparency and conflict of interest for public officials. But it is also clear that it is in the interest of people in power to keep these provisions in their current state. “Wealth is concentrated in a very few hands because we elect politicians who are the rich guys and who control the wealth," Guevarra says. “So forever they will perpetuate their control of the wealth because … we elect them to positions of power where they can formulate policies and laws of the land. Kawawa naman tayo!" —With reports from Aedrianne Acar, Jamaica Jane Pascual and Allan Crispulo Vallarta, GMA News Research

Both Fine and Adelfa have been declared in Villar’s SALN since 1993. These two companies link Villar to more than 20 other business entities. Should all these inter-linked companies then be listed in the SALN? Former Civil Service Commission Chair Karina David says it is acceptable for public officials to declare only companies where they, as individuals, have actual interests in. “Kunyari ako, part owner ng company A, ang company A, created company B, wala na ako doon," David says. David is the author of the revised SALN form introduced for 2007. This format requires the public official to declare a baseline data, or a “comprehensive listing of all assets, liabilities, net worth, business interests and financial connections" using the year 2007, or the first year of filing, as reference. The succeeding annual SALNs will only reflect the changes from the initial declaration, either addition (if there is an increase in assets/ income) or deduction for additional liabilities. "Di ba mas maganda na minsan lang, the moment you come into government, dun ka lang nagde-declare ng lahat ng bituka mo. Tapos every year, I think 70 percent or 80 percent of the bureaucracy will simply say 'no change,' " David says. On the question of whether Vista Land should be in Villar’s SALN, Prof. Solita Monsod says, "He [Villar] does not have to declare it [Vista Land] because he already declared Adelfa [and Fine Properties]. Wala syang problema..." Prof. Monsod was head of the National Economic and Development Authority and now chair of The Movement for Good Governance, a civil society organization. “He owns the holding company. The holding company owns another entity. As long as he says he owns the holding company, ikaw na bahala magsabi kung saan yun [other business interests]. [Because] yung profits ng companies owned by the holding company goes to the holding company," Monsod says. While David says this kind of disclosure is acceptable and may be taken as compliance with the law, she likewise notes that compliance is not necessarily equivalent to transparency. “It’s so smoke-screened eh. How can you keep on earning so much money… simply because a great set of lawyers was able to hide you from all these things?" she said. “As usual, lawyers can forget about the spirit of the law and ‘technical’ you all over the place." The issue of disclosure of layered business entities is not unique to Senator Villar. Luisita Realty Corp. was not among the business interests listed in the SALNs of Senator Aquino. This company declared net income of P65 Million in 2005. SEC records show that 40 percent of the real estate company is owned by Tarlac Development Corporation. TDC has been in Aquino’s SALN since he started filing in 1998. In a similar case, Consolidated Mines Inc does not appear in Madrigal’s SALN. But AP Madrigal Steamship Company Inc and The Solid Guaranty Inc, companies listed in Madrigal’s SALNs, are stockholders of Consolidated Mines. The senator was VP for Operations, Member of the Board and stockholder of AP Madrigal Steamship from 2004 to 2008. Madrigal was Chairman of the Board and stockholder of Solid Guaranty in 2007. Declare all The word from the Office of the Ombudsman is clear and simple: just declare everything, layers and all. De Jesus says, “Well even if there are layers, I believe that he should declare all of them." "The law requires full disclosure, full disclosure," repeats the assistant Ombudsman for emphasis. “And if a lifestyle check is done on the public official, and it was found out that he did not declare the other companies that he owns or manages... he might be accused of - remember the declaration in the SALN is under oath - perjury or even falsification. Worse, there could be a petition for forfeiture of ill-gotten wealth." While these fighting words may intend to put the fear of God in every public official, the Ombudsman in some ways is a paper tiger. De Jesus explains there has to be a complainant for the Ombudsman to trigger an investigation into anybody’s SALN. There are three Deputy Ombudsman for Luzon, Visayas and Mindanao and a Deputy Ombudsman for the Military and other law enforcement offices. The Office of the Ombudsman is the repository of the required declarations of 1.4 million that make up the government bureaucracy. As is, the Office of the Ombudsman has enough on its plate. The onus therefore is on the complainant. “The burden of proof is on the complainant, to prove that this public official or employee has an ill-gotten wealth. Or that he committed perjury or falsification because by omission, he did not declare," De Jesus said. And, De Jesus adds, there should be some leeway for certain lapses. “But you know, you also have to consider good faith on the part of the declarant," he says. “Eh sa dami naman nga nyan, eh kung hindi naman nya maalala lahat, at nakalimutan din ng kanyang secretary, we cannot blame, as long as he declares that he has interests in these corporations: this is the mother unit, there are smaller units." But David counters, “There are limits naman to good faith." “To say that you forgot to declare a huge chunk [of your wealth or] you forgot to declare the income of your husband, eh it’s unbelievable. If everything is good faith wag na tayo magpa-submit," she says. Vague, inconsistent entries There seems to be greater leeway in the declaration of real estate properties whose worth can vary depending on the measure used. From 1994 to 1996, Delos Reyes used the assessed values of his two properties in Subic Bay Metropolitan Authority and in Olongapo City. In 1997, he started computing the value of the same properties using the fair market values. Teodoro has declared a condominium property in Makati since July 1998 to 2007 with an acquisition cost of P10 Million. In 2008, the declared acquisition value of the same property changed to PHP 17,482,000. Villar’s declared from 1997 to 2001 a residential property on Naga Road in Las Piñas with an acquisition cost of P500,000. From 2002 to 2006, the acquisition cost for the same property became P600,000. Monsod says consistency is important in declaring the value of properties. “As long as you are consistent in the [values you use], then you have no problem. Because you cannot use one value for one asset and the fair market value for the other depending on what you like," she says. The 2007 revised SALN requires the acquisition costs and either the fair market or assessed value of real estate properties. In some declarations, the assets are simply lumped under a general, all-encompassing heading. Madrigal, for example, declared P90.48 Million under “shares of stocks." She did not identify where the investments were. This amount was equivalent to 59 percent of her declared totals assets in 2008. From 1992 to 2006, Villar declared multi-million-peso assets under “investment in shares of stocks" and “other personal assets/properties" but did not identify the companies. In 2008, he listed assets worth P789,235,608.00 under “receivables and other personal and real properties." This “receivable", equivalent to 75 percent of his declared assets and net worth, does not indicate where the sum will be coming from. Unlike many filers who invest in the stock market, Gordon identified investments made in publicly listed companies. Among all the presidential bets with SALN records, Gordon’s SALN declarations matched all the business records GMA News Research obtained from the SEC. There was only one inscrutable entry in his SALN, notable for the huge amount -- the lump declaration of his liabilities. Gordon declared liabilities worth P28,296,942 in 2008. This amount was 51 percent of his declared total assets. His liabilities listed only under “personal loan" started at P9 Million in 2001 and reached P28.7 Million in 2007. While Gordon declared liabilities worth more than half of his fortunes, Villar says he has none. Since December 1995, Villar has been declaring no liabilities. But what about the Villar companies that had gone belly up? Manuela Corporation, declared by Villar in his 1993 SALN, is under court rehabilitation based on its 2007 financial statement. In a 2007 decision on Manuela’s rehabilitation, the Supreme Court described the company as “having severe cash flow payments which prevent it from paying its debts as they fall due." Capitol Development Bank was in Villar’s SALN from 1993 to 1997. In 1998, Capitol secured a P1.5B emergency loan from the Bangko Sentral ng Pilipinas (BSP). The bank’s president then was Cynthia Villar, wife of Manny Villar, who was congressman at the time. When CDB failed to pay, the BSP secured real estate collaterals in the foreclosure proceedings. Capitol Development Bank has since been renamed Optimum Development Bank in 1999. Optimum is a stockholder of Manuela in the latter’s 2007 financial statement. Monsod sees no problem with these not being reflected in Villar’s SALN. “Eh kasi personal [SALN] nya yun eh, ang corporations nya ang may liabilities," Monsod said. “You must remember, yung utang is utang ng corporations nya. Eh nilista na nya… Ang corporations nya ang may liabilities." David says that there is no legal problem with not declaring corporate liabilities: “As usual, lawyers can forget about the spirit of the law and ‘technical’ you all over the place." She stressed, however, that the bottom line should always be transparency. “Alam mo, maraming magic na nangyayari sa business," she says. “They can answer you legally. Yung mga korporasyon may liabilities, ang tao wala… Pero yung tao ang laki-laki ng nakukuhang profits from these corporations. Obviously there’s something wrong. They just have good lawyers." Nothing to declare The ideal case, the assistant Ombudsman says, is to have nothing to declare. In a perfect world, government officials and employees would not have business interests at all because the law prohibits conflict of interest. “For example me, if I were an owner or a majority stockholder of a corporation, I will have to divest. I will have to sell out or donate my shares. I cannot practice my profession as a lawyer because I am required by the law to be a full time officer of the Office of the Ombudsman," he said. RA 6713 says there is conflict of interest if the official or employee is a substantial stockholder, or a member of the Board of Directors; or an officer of the corporation; or an owner or has substantial interest in a business; or partner in a partnership; and if the interest of the business affects the performance of his duties. For Guevarra, the involvement in any business is already conflict of interest. “They can justify their [wealth] through their businesses. [But] how do you separate how much income you have generated because of your connections, because of your power?" she asks. Guevarra says personal interests are bound to interfere with public service. “If there are laws... that may have a negative impact on your business, the probability is you will not be objective. Kasi you will be torn eh, between two lovers," she says. “Are you going to do what is good for the country, but at the same time it would harm your business interests?" But what we have is far from a perfect world. And as such, government has forms that need to be filled out. "Any form is always dangerous to small people," David says. "Because kahit sinong maliit na tao na maka-away mo, hahanapan ka at hahanapan ng butas… Even if it won’t stand up in court, you go through an entire process." In creating the 2007 SALN form, David simply wants an instrument that will make it easy for people to be honest. “Bakit mo pahihirapan yung 1.4 million government employees na karamihan naman dyan wala halos ma-declare," she says. "People who want to hide their corruption will find a way of hiding anyway." But from the perspective of the Ombudsman, the SALN should be an instrument that should help them go after crooks in government. Since SALN declarations are made under oath, those proven to have wrongfully declared their assets, liabilities and net worth may be held liable for perjury. "Ang perspective ng Ombudsman even during the time of [former Ombudsman Simeon] Marcelo was to come out with a form so that they would be able to find out all they needed in the form," David says. And now, the Ombudsman is working on a new form. “Bago na naman?" David says dryly. The Ombudsman, after all, has not had much success in the use of the SALNs for big-time prosecution. While the plunder case against Estrada prospered, the Sandiganbayan acquitted him of perjury for his erroneous SALN declarations. The landmark conviction eclipsed the government’s loss in the other battle. In the perjury decision, the Sandiganbayan said that while the prosecution was able to establish the omissions in his SALN, it was unable to prove that Estrada “deliberately and willfully committed a falsehood." “In order to be liable for perjury, the falsehood committed by the accused in his sworn statement must be deliberate and willful," the court explained. Even the recent developments from the Office of the Ombudsman had clearly not pointed in the direction of transparency and better public access, but in fact toward the protection of the public official. Last year, Ombudsman Merceditas Guttierrez issued a memo that made it harder to access the SALNs, which are public documents. The requesting party is now required to have his request sworn before an Ombudsman prosecutor. The memo reminds the requesting party that his written request shall be readily made available to the owner of the SALN, “who may avail himself of all legal remedies against the requesting party should said official or employee feel that the requesting party has unlawfully encroached on the former’s right to privacy." Clearly, there is much to be desired in the provisions on transparency and conflict of interest for public officials. But it is also clear that it is in the interest of people in power to keep these provisions in their current state. “Wealth is concentrated in a very few hands because we elect politicians who are the rich guys and who control the wealth," Guevarra says. “So forever they will perpetuate their control of the wealth because … we elect them to positions of power where they can formulate policies and laws of the land. Kawawa naman tayo!" —With reports from Aedrianne Acar, Jamaica Jane Pascual and Allan Crispulo Vallarta, GMA News Research