Filtered by: Money

Money

‘Scope’ for keeping interest rates low narrows down — BSP

(Updated 8:49 p.m.) The “scope" for keeping key interest rates at record lows has narrowed down as food and petroleum prices continue to add pressure on inflation, the Bangko Sentral ng Pilipinas said Wednesday. The central bank’s latest position on policy rates, kept unchanged since July 2009, may be the smoke signal heralding the onset of higher interest rates in the Philippines starting this month. "Indeed, the scope for keeping rates has narrowed," BSP Gov. Amando Tetangco Jr. said in a text message to reporters. “The BSP will make any further adjustments to policy as and when necessary," he added. The policy-setting Monetary Board last month raised its inflation forecasts for 2011 to 4.4 percent from 3.6 percent, and to 3.5 percent from 3 percent for next year, saying the numbers still fall within the target of 3 percent to 5 percent between 2011 and 2014.  Such view toward inflation has given the central bank and its Monetary Board enough leeway to keep the overnight borrowing rate at a record 4 percent and the overnight lending rate at 6 percent for 14 straight policy-setting meetings since July 2009. The next policy-setting meeting is scheduled for March 24. The Monetary Board’s policy stance has helped the Philippine economy grow 7.3 percent in terms of gross domestic product last year, the fastest in 34 years. The country barely escaped the global recession, with the GDP growing 1.1 percent in 2009, from 3.8 percent in 2008. "We are mindful of the improved growth for the country, particularly given the better than expected growth performance last year," Tetangco said. “We are monitoring this against inflation and inflation expectations," the central bank governor added. Recession-related measures lifted The recovery allowed monetary authorities to lift several recession-related measures as early as January last year, including raising the rate on short-term lending facility to 4 percent from 3.5 percent. They also reduced the peso rediscounting budget to P20 billion from P60 billion, and restored the loan value of all eligible rediscounting papers to 80 percent from 90 percent of the borrowing bank’s credit instrument. The non-performing loan ratio requirement of 2 percentage points from 10 percentage points was also restored What the monetary authorities decided to keep was the 19-percent reserve requirement of banks, from 21 percent, to release more money into the financial system. The reserve requirement, which may not be lent to borrowers, is the percentage of bank deposits and deposit substitute liabilities that banks must keep on hand or in deposits with the BSP. "The BSP has already begun the normalization process when it lifted the liquidity enhancing measures, including the valuation and pricing on rediscount facility," he said. The Philippines is so far the only country in Asia that has not adjusted its key policy rates since global economies started showing signs of a recovery from the financial crisis. Last January, the country's inflation quickened to a four-month high of 3.5 percent from 3 percent in December. The BSP sees inflation ranging between 3 percent and 4.1 percent for February. The average inflation in the country climbed to 3.8 percent last year from 3.2 percent in 2009. The balance of risks to the inflation outlook has tilted further toward the upside with more risks and inflationary pressures expected in the near future, according to analysts. Such risks include food supply shocks as global food prices go up, higher rice prices, the impact of weather disturbances on agriculture output, higher crude oil prices, and pending petitions for electricity rate increases. Be prepared to adjust Multilateral lender International Monetary Fund (IMF) said in its latest Public Information Notice that monetary authorities should be prepared to adjust its key policy rates when necessary and inflation pressures continued to build-up. "Given a potential buildup of price pressures in the near term, they encouraged the authorities to stand ready to tighten the monetary stance to head off inflation risks," the multilateral lender said in its March 1 notice. The BSP's policy stance had succeeded in keeping inflation low while fostering economic recovery and at the same time gradually unwinding liquidity support measures, it said. Its Executive Board concluded the Article IV Consultation with the Philippines on Feb. 18, which is part of the yearly bilateral meeting the fund holds with members for economic and financial information gathering. Economic development and policies are also discussed in those consultations. For the Philippines, the IMF Executive Board stressed the need for the right mix of policy tools to manage foreign capital inflows and to facilitate productive use such money. It supports the central bank’s policy of allowing the exchange rate to reflect market pressures and limiting intervention in the foreign exchange market. "With the exchange rate broadly in line with fundamentals and reserves comfortable, greater exchange rate flexibility could be considered in response to additional inflows," the IMF said. IMF sees Philippine GDP slowing down to 5 percent this year and expects average inflation to climb to 3.9 percent. — VS, GMA News

Such view toward inflation has given the central bank and its Monetary Board enough leeway to keep the overnight borrowing rate at a record 4 percent and the overnight lending rate at 6 percent for 14 straight policy-setting meetings since July 2009. The next policy-setting meeting is scheduled for March 24. The Monetary Board’s policy stance has helped the Philippine economy grow 7.3 percent in terms of gross domestic product last year, the fastest in 34 years. The country barely escaped the global recession, with the GDP growing 1.1 percent in 2009, from 3.8 percent in 2008. "We are mindful of the improved growth for the country, particularly given the better than expected growth performance last year," Tetangco said. “We are monitoring this against inflation and inflation expectations," the central bank governor added. Recession-related measures lifted The recovery allowed monetary authorities to lift several recession-related measures as early as January last year, including raising the rate on short-term lending facility to 4 percent from 3.5 percent. They also reduced the peso rediscounting budget to P20 billion from P60 billion, and restored the loan value of all eligible rediscounting papers to 80 percent from 90 percent of the borrowing bank’s credit instrument. The non-performing loan ratio requirement of 2 percentage points from 10 percentage points was also restored What the monetary authorities decided to keep was the 19-percent reserve requirement of banks, from 21 percent, to release more money into the financial system. The reserve requirement, which may not be lent to borrowers, is the percentage of bank deposits and deposit substitute liabilities that banks must keep on hand or in deposits with the BSP. "The BSP has already begun the normalization process when it lifted the liquidity enhancing measures, including the valuation and pricing on rediscount facility," he said. The Philippines is so far the only country in Asia that has not adjusted its key policy rates since global economies started showing signs of a recovery from the financial crisis. Last January, the country's inflation quickened to a four-month high of 3.5 percent from 3 percent in December. The BSP sees inflation ranging between 3 percent and 4.1 percent for February. The average inflation in the country climbed to 3.8 percent last year from 3.2 percent in 2009. The balance of risks to the inflation outlook has tilted further toward the upside with more risks and inflationary pressures expected in the near future, according to analysts. Such risks include food supply shocks as global food prices go up, higher rice prices, the impact of weather disturbances on agriculture output, higher crude oil prices, and pending petitions for electricity rate increases. Be prepared to adjust Multilateral lender International Monetary Fund (IMF) said in its latest Public Information Notice that monetary authorities should be prepared to adjust its key policy rates when necessary and inflation pressures continued to build-up. "Given a potential buildup of price pressures in the near term, they encouraged the authorities to stand ready to tighten the monetary stance to head off inflation risks," the multilateral lender said in its March 1 notice. The BSP's policy stance had succeeded in keeping inflation low while fostering economic recovery and at the same time gradually unwinding liquidity support measures, it said. Its Executive Board concluded the Article IV Consultation with the Philippines on Feb. 18, which is part of the yearly bilateral meeting the fund holds with members for economic and financial information gathering. Economic development and policies are also discussed in those consultations. For the Philippines, the IMF Executive Board stressed the need for the right mix of policy tools to manage foreign capital inflows and to facilitate productive use such money. It supports the central bank’s policy of allowing the exchange rate to reflect market pressures and limiting intervention in the foreign exchange market. "With the exchange rate broadly in line with fundamentals and reserves comfortable, greater exchange rate flexibility could be considered in response to additional inflows," the IMF said. IMF sees Philippine GDP slowing down to 5 percent this year and expects average inflation to climb to 3.9 percent. — VS, GMA News

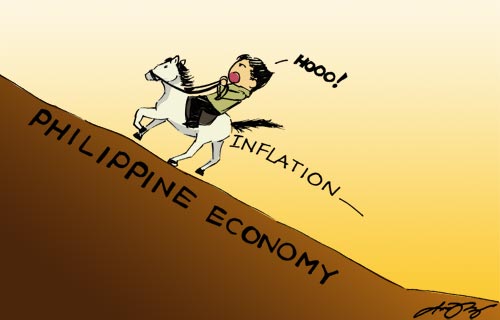

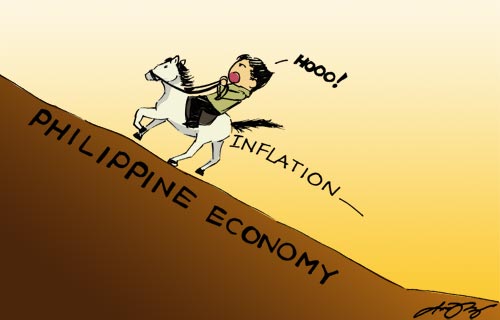

Reining in inflation with interest rate Analyn Perez, GMA News

Find out your candidates' profile

Find the latest news

Find out individual candidate platforms

Choose your candidates and print out your selection.

Voter Demographics

More Videos

Most Popular