Angara urges CHED to create fund for schools

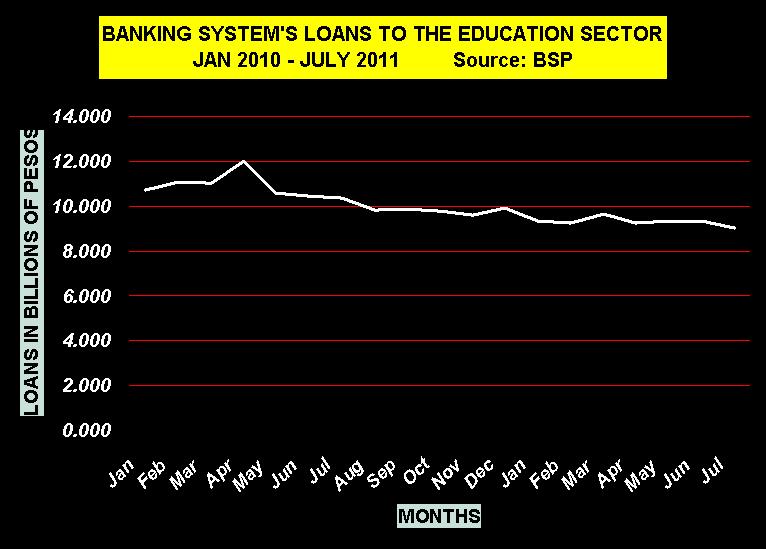

Senator Edgardo J. Angara prodded the Commission on Higher Education (CHED) to work with the Development Bank of the Philippines (DBP) and Land Bank of the Philippines (LBP) to create a funding source for capital outlays and financial aid to students. "We need to look for a long-term, and not just band-aid, solutions to the perennial problem we face every year during budget deliberations: lack of funds for capital outlay, and unrest among students because of yearly tuition increase," said Angara during the hearing on budgets of the state universities and colleges (SUCs) on Thursday. Angara urged CHED Chairperson Dr. Patricia Licuanan “to create a central government institution that will provide affordable and accessible financial assistance to both students and teachers, including capital outlay for the construction of laboratories and buildings for both private and public schools." The senator, who chairs the Senate committee on education, arts and culture, noted that the national government has not given the SUCs any budget for capital outlay over the past few years. "We can ask the national government to provide a seed capital of P5 Billion so our government banks can setup a window that will provide assistance for the twin needs of financial assistance and capital outlay," Angara explained. He said similar programs were set-up and operate in Latin America and can be replicated locally. "The DBP has P9 billion in reserves while the Land Bank earns P2 billion a year. They are government banks after all, and instead of keeping this much money, we must spread the benefit to those who need it," Angara said. Low loans availment Loans of local banks to the education sector have been on a steady decline since January 2010, according to data of the Bangko Sentral ng Pilipinas. Education got only 0.4 percent of the P46.83 trillion the country’s banks lent to all industries and consumers. From January 2010 to July 2011, the education sector got a total P190.34 billion in bank financing compared to the P7.06 trillion the manufacturing sector got as loans from the banks.